25+ Income payment calculator

This calculator determines the monthly payment and estimates the total payments under the income-based repayment plan IBR. You can use an income tax calculator online to quickly understand your tax liabilityThe income tax calculator is a simple tool that gets updated with the latest rules and regulations and shows you your accurate income tax liability for the yearTo understand how much income tax you need to pay for the financial year ending on 31 st March 2022 use our.

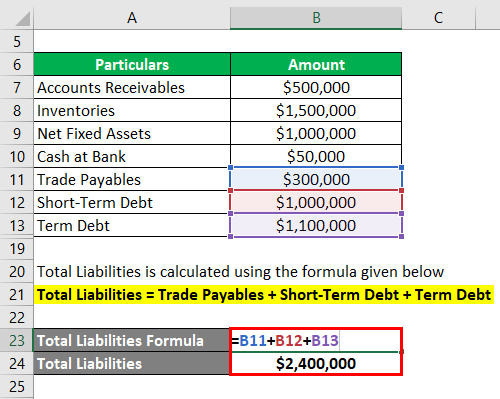

Net Worth Formula Calculator Examples With Excel Template

Student Loan Payment Calculator.

. Its base sales tax rate of 725 is higher than that of any other state and its top marginal income tax rate of 133 is the highest state income tax rate in the country. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. In addition to calculating the late fee the calculator will also calculate the daily penalty interest rate and the total amount due.

A DTI of 12 50 or more is generally considered too high as it means at least half of income is spent solely on debt. Our income tax calculator calculates your federal state and local taxes based on several key inputs. IBR caps your monthly payment at 15 of your discretionary income and offers forgiveness after 25 years of qualifying payments.

Increase IncomeThis can be done through working overtime taking on a second job asking for a salary increase or generating money from a hobby. That means the actual rates paid in Utah. Thankyou for prompt payment of refund within 20 days of filing of return.

The loan amount the interest rate and the term of the loan can have a dramatic effect on the total amount you will eventually pay on a loan. The 025 auto-pay interest rate reduction applies as long as a valid bank account is designated for required monthly payments. It is possible that a calculation may result in a certain monthly payment that is not enough to repay the principal and interest on a loan.

Begin with the gross monthly earnings of 1257. While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied. California has among the highest taxes in the nation.

Besides checking your income debts and credit score its important to prepare enough down payment. Your household income location filing status and number of personal exemptions. The Alberta mortgage calculator takes the following federal regulations into account.

Use our loan payment calculator to determine the payment and see the impact of these variables on a specified loan amount complete with an amortization schedule. For homes over 1 million the minimum down payment is 20 of the total purchase price. Step 1 Gross Income.

Advance tax payment on non-TDS deducted income from self-employment professional service business capital gains or any other source require few simple steps. Step 2 Net Income for Shelter Deduction. Local rates which are collected at the county and city level range from 125 to 420.

529 Plan Ratings and Rankings. Subtract the standard deduction for a three-person household 177. Simply add the extra into the Monthly Pay section of the calculator.

An admission application to any state funded school - paragraph 19 n of the School Admissions Code 2012 rules out requests for financial contributions as. Our income tax calculator calculates your federal state and local taxes based on several key inputs. That puts Oklahomas top income tax rate in the bottom half of all states.

Date for filing Form 10AB extended till 30th September 2022. Use Ratehubcas Mortgage Affordability Calculator to help figure out the maximum purchase price that you can. The Sooner States property taxes are also below average with an average effective rate of 087 25th-lowest in the US.

Canadas minimum down payment is 5 for the homes value under 500000 then 10 of the part of the price between 500000 and 1 million. 10000 IBR Loan with a 7 gross income payment percentage for a Senior student making 65000 annually throughout the life of the loan. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

A 900000 home with a 5 interest rate for 30 years and 45000 5 down requires an annual income of 218403. How to Lower Debt-to-Income Ratio. The state rate is 485.

For example even if you have good credit a sizeable down payment and no debts but an unstable income you might have difficulty. The Golden State fares slightly better where real estate is concerned though. Your household income location filing status and number of personal exemptions.

Ideally financial advisors recommend paying 20 down on your homes. Advance tax payment of companies is usually carried out by their accounts section using challan 280. Retirement plan income calculator.

This calculator can also estimate how early a person who has some extra money at the end of each month can pay off their loan. How much do I need to make for a 900000 house. Consider a family of three with one full-time minimum-wage worker two children dependent care costs of 78 a month and shelter costs of 993 per month.

How Income Taxes Are Calculated. Your household income location filing status and number of personal exemptions. Using our calculator above.

Save Enough Down Payment. Your Statutory Sick Pay SSP - how much you get eligibility how to claim SSP fit notes disputes. For the 2021 tax year Oklahomas top income tax rate is 5.

The calculator will then reply with an income value with which you compare your current income. Use our loan payment calculator to determine the payment and see the impact of these variables on a specified loan amount complete with an amortization schedule. Individuals can pay advance taxes online or offline through challan 280.

The loan amount the interest rate and the term of the loan can have a dramatic effect on the total amount you will eventually pay on a loan. Pay As You Earn PAYE limits your monthly. This Late Fee Calculator will help you to quickly calculate the interest penalty on overdue invoices.

An example would be if you had 100000 in savings and used all of it to finance a 500000 property with a 2500 monthly mortgage payment when your net income is 3000 per month. Like private student loan amounts private student loan. Refer Circular 8 under News Updates.

If debt level stays the same a higher. Plus if you name and save your entries under the Data tab you can quickly update the penalty interest on future billing statements just by changing. It has been the fastest refund I got in my life since filing my income tax return in 32 years.

If you are seeking a loan for a format without a front-end limit you can set the front-end box to 100 for 100. However student loans that are under an alternative payment plan offer terms from 10 to 25 years. Free loan calculator to find the repayment plan interest cost and amortization schedule of conventional amortized loans deferred payment loans and bonds.

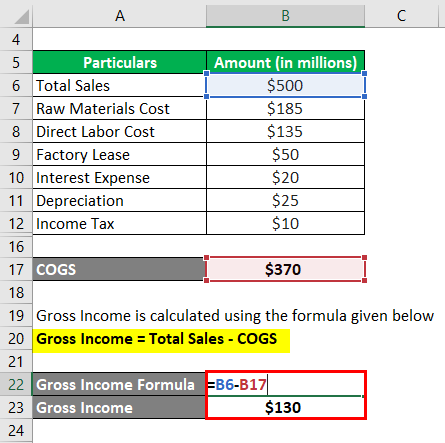

Gross Income Formula Calculator Examples With Excel Template

Gross Income Formula Calculator Examples With Excel Template

7 Free Printable Budgeting Worksheets Budgeting Budgeting Money Budgeting Worksheets

Grant Proposal Budget Template Grant Proposal Grant Writing Proposal

Living On A Low Income Successfully 25 Top Tips Budgeting Money Saving Money Budget Money Saving Strategies

Acres To Hectares Conversion Chart Weight Conversion Chart Weight Conversion Pounds To Kilograms Conversion

Intelligent Free Excel Budget Calculator Spreadsheet Download Personalize Personal Budget Template Budget Calculator Excel Budget

How To Thrive And Not Just Survive On One Income Frugal Best Money Saving Tips Finance Tips

25 Aesthetic Notion Templates Theme Ideas For 2022 Gridfiti Finance Tracker Notions Finance Dashboard

Tips For Creating A Budget Affordable Health Insurance Budgeting Budgeting Money

Free 50 30 20 Budget Calculator For Your Foundation Template

Mypoints Review 2022 Can You Redeem Points For Cash Life On A Budget Mypoints Make Easy Money

25 Debt Quotes Debt Quote Accomplishment Quotes Impress Quotes

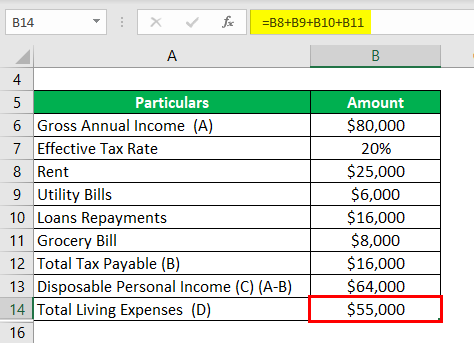

Disposable Income Formula Examples With Excel Template

Excel Formula Calculate Percent Variance Exceljet

How To Calculate Gross Income Per Month

Real Estate Calculator For Analyzing Investment Property Investment Property Real Estate Tips Investing